OMA Project (amended 12/19/14)

OMA Project (amended 12/19/14)

The OMA Project is located at the corner of Monument Avenue and Lombardy Street at one of the most famed and picturesque intersections in the Richmond Metro area. The mixed use project was developed in the former Stuart Circle Hospital (approx 2004) using the Historic Tax Credit programs. It was designed as a high end apartment complex with plans to convert to condominiums after the mandatory 5 year hold period. Due to the success of the project as an income producing property and the market conditions in 2008-2011, the owners decided not to execute the conversion.

- Fan District/Monument Avenue

- 38 Residential Units

- 30,000 SF Commercial Space

- 200+ Parking Spaces

- Developed in 2004 (appox.)

Richmond Neighborhoods at a Glance

Competitive Projects at a Glance

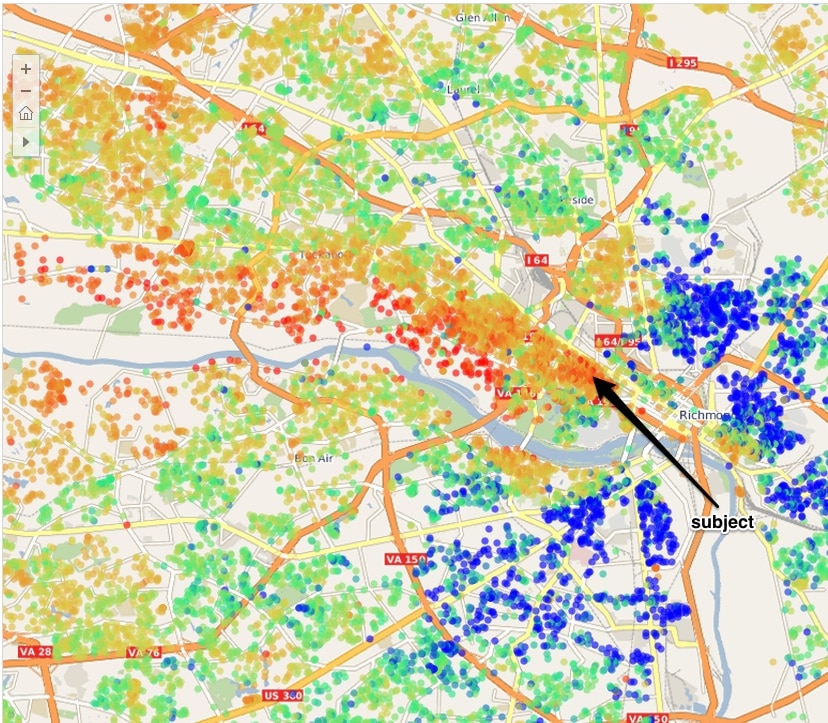

Heat Map of Sale Quality in the Metro

The ‘Sale Quality‘ measurement was created by combining both the ‘Price per Foot’ and the ‘Aggregate Price’ of a home to give an overall view of the demand of an area. Effectively, this chart displays the homes which commanded both high pricing AND high per foot pricing. We feel this is a more accurate measurement of actual value than either statistic measured individually.

Summary Market Conditions/Relevant Market Statistics

[ Link to MLS Printout Here ]

Data Pull – November 17, 2014 (see charts at the bottom for the entire 23220 Zip Code)

The following data comes from CVR MLS and includes both single family and condo sales from within Richmond’s Fan District. While we feel the available universe of buyers will come from well beyond the boundaries of the Fan, the pricing will be largely driven by comparable pricing from within the Fan.

Additionally, the net new condo product delivered to the marketplace has been effectively ‘ZERO’ since the last ‘pre-crash’ projects were completed and brought to market in 2009. The last new project within the Fan District (The Cary Mews) was sold out by 2010 (One South Realty represented the seller).

- 91 condos absorbed from 1/1/13 – 11/17/14

- Average Per Foot – $203/SF

- Average Price – $239,620

- Average Size – 1143/SF

- Average DOM – 64 Days

- Absorption – 3.95 Units/Month

- 249 single family homes absorbed since 1/1/13 – 11/17/14

- Average Per Foot – $189/SF

- Average Price – $524,772

- Average Size – 2792/SF

- Average DOM – 39 Days (Median = 16)

- Absorption – 10.82 Units/Month

Suggested Pricing

Based on a combination of comparable sales, predictive estimates, experiential gut feel for market and other factors, we feel as the BASE PRICE price for the product should approximately $235-240/SF. This $235- 240/SF figure needs to be adjusted up or down based on physical features (layout/views/level) and other condo association related/strategic decisions (dues, compliance, finish level, warranty, mortgage finance).

Vertical projects have a probable ‘per foot’ variance of +20% depending on number of floors, views and private outdoor space.

Final pricing can only be determined when we specifically walk the property with our pricing matrix and when we understand the developer’s strategy around the following factors:

Factors Which Impact Pricing

In addition to physical characteristics of the condo, the following factors can dramatically impact condo valuations/absorption:

- Fannie Mae/Freddie Mac Compliance – We have strategies to account for the lack of initial conventional financing but cannot stress enough the importance of the need for conventional financing option in order for ownership to achieve maximum value. Factors which can impact mortgage finance include:

- Owner Occupant vs Renter Percentage

- Pre-Sold Levels

- Commercial Space Percentage

- Dues Structure

- Condo Association Bylaws

- Vacancy – If you plan to vacate the units and renovate/refurbish, it can have a dramatic impact on both pricing and absorption. Tenant occupied units will sell at a steep discount to market and at a far slower rates. Two strategies exist to convert with positives and negatives each:

- Create Vacancy ‘En Masse’ – the developer forces immediate vacancy with loss rental income but minimizes renter/owner and construction stress. Additionally, vacancy indicates a commitment to sales to both market and lenders, which is important.

- Create ‘Strategic Vacancy’ – the developer allows leases to terminate naturally without renewal and/or provides incentive for certain tenants to vacate in a manner which balances unit availability. This method maximizes rental income but creates logistical and management issues with owners/tenants and potential contractors co-existing. Slow creation of vacancy creates doubt of the developer’s commitment level to conversion and runs the risk of the dreaded ‘fractured’ condo.

- Renovation/Warranty – Fresh paint, repaired/renovated floors, baths, kitchens and/or appliances is suggested. The market will overly punish values for relatively minor cosmetic issues. Additionally, strong language/policy around the warranties for HVAC and appliance/other equipment will also be important for a buyer.

Other Strategies Which Impact Sales

We also have several suggestions around execution of the project which can be discussed when developing the division of duties outlined in a listing agreement:

- staging

- model units

- decor

- color palates

- web

- incentives

- price increases

- improvements

- selection of management company

- selection of attorney for creation of condo bylaws

- dues

- mortgage company alliance

Summary

Per your request, we have created a basic ‘Per Foot’ estimate on the average sales pricing of the project. It has been our experience in representing numerous projects throughout Richmond since 2007, that the best pricing will be achieved when all relevant factors are accounted for.

Suggested reading (all articles written by One South Realty)

- Converting Apartments to Condos

- The Problem with Condo Lending

- Risk Mitigation in the Condo Purchase

One South Realty Project Representation

- Ginter Place – 69 upscale condo units (66 sold)

- Citizen 6 – 6 upscale Townhomes in the Fan sold $250/SF+ before c.o.

- Emrick Flats – 25 industrial condo units + 2000 SF of Commercial Space

- Marshall Street Bakery – 23 industrial condo units + 3500 SF of Commercial Space

- The Reserve – 25 condo units in two phases

- The Cary Mews – 14 Condo Units in two phases

- Tribeca Brownstones – 23 Total Townhomes built in 3 phases

- Ashley Terrace – 176 conversion of apartments to affordable housing units

References (contact information provided upon request)

- Ted Ukrop, Developer of Ginter Place

- Sam McDonald, Developer of the Emrick Flats

- Hugh Shytle/Herb Coleman, Developers of the Emrick Flats and The Reserve

- Chris Johnson, Principal at Monument Construction and Developer of The Cary Mews

- Bill Chapman, Developer of Citizen 6

One South Web Assets

Our web strategy is one of the most aggressive and far reaching in the RVA marketplace.

- RichmondVACondos.net – our site specific to condos with many Google Page 1 rankings for various projects

- RichmondVAMLS.net – our general search site with many Google Page 1 rankings for many neighborhoods and projects

- RichmondLuxuryNeighborhoods.com – our site dedicated to the finest neighborhoods in Richmond

- RichmondFanRealEstate.net – our site dedicated to the Fan District

- OneSouthRealty.com – our brokerage’s site

- We also have a host of other smaller sites with more ‘niche’ appeals which would indirectly help the OMC marketing efforts

We have the ability to feature any of our listings/projects in the 4-5 most likely web based entry points. We also have the ability to create a property specific site in house for OMC if the developer chooses to launch a sales-based site.